Many small businesses face the challenge of seasonal sales swings. Revenue might spike during holidays and crash during slow months. This rollercoaster makes it hard to plan, pay bills, and manage cash flow. Here’s how to smooth out seasonal fluctuations and keep your business stable year-round.

Track your patterns carefully

Start by understanding exactly when your busy and slow periods happen. Look at sales data from the past two to three years. Note which months are strongest and weakest.

Don’t just look at total sales. Break down the data by product lines, services, or customer types. You might find that while overall sales drop in summer, certain products actually sell better.

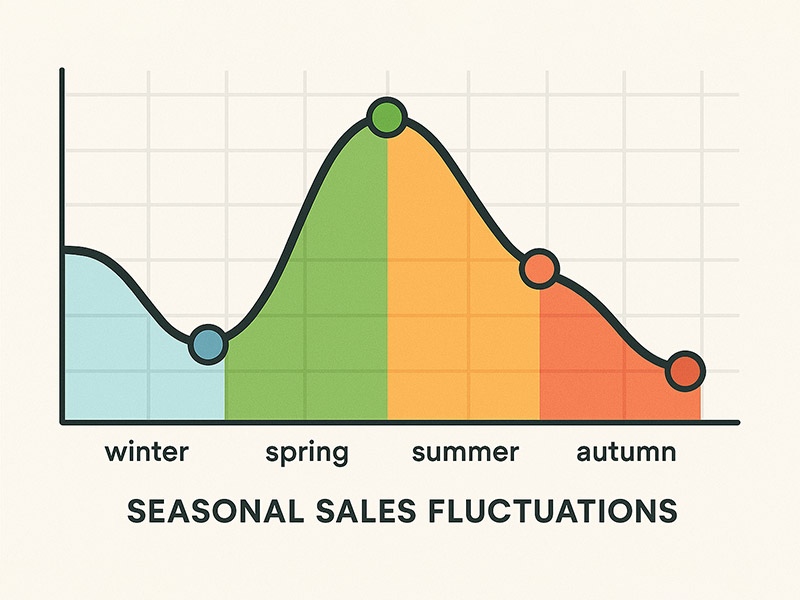

Create a simple chart showing monthly revenue patterns. This visual guide helps you predict cash flow needs and plan inventory purchases. Update this chart each year as your business evolves.

Many business owners think they know their patterns but get surprised when they actually analyze the numbers. The data often reveals opportunities they missed.

Build cash reserves during peak seasons

When money flows in during busy periods, resist the urge to spend it all immediately. Instead, set aside money for slower months ahead.

Calculate how much you typically need to cover expenses during your slowest quarter. Save at least this amount during peak seasons. Open a separate savings account specifically for seasonal reserves.

This cash cushion prevents you from panicking during slow periods or taking on expensive debt to cover basic expenses. It also gives you flexibility to invest in opportunities that arise during off-seasons.

Think of seasonal savings as paying yourself a salary. During busy months, you’re earning money for the slower months when you’ll need it.

Diversify your revenue streams

Relying on one product or service makes seasonal swings more dramatic. Look for ways to add revenue sources that peak at different times of year.

A landscaping company might add snow removal services. A tax preparation business could offer bookkeeping services year-round. A beach resort might target business conferences during off-season months.

Consider products or services that complement your existing expertise but appeal to customers during different seasons. This doesn’t mean completely changing your business model, just adding elements that balance out the fluctuations.

Partner with businesses that have opposite seasonal patterns. A wedding planner might team up with a holiday event coordinator to share resources and referrals.

Adjust staffing strategically

Don’t maintain peak-season staffing levels year-round. Plan your workforce around your seasonal patterns.

Hire temporary employees during busy seasons rather than permanent staff you can’t afford during slow periods. Use temp agencies, seasonal workers, or part-time employees who understand the temporary nature of the work.

Cross-train existing employees to handle multiple roles. This flexibility lets you maintain service quality with fewer people during slow seasons.

Consider offering existing employees unpaid time off during slow periods. Some workers appreciate extra vacation time, and you save on payroll costs.

Be upfront with seasonal employees about the temporary nature of their positions. This honesty helps you find workers who fit your needs and reduces turnover problems.

Plan inventory and purchasing

Avoid getting stuck with expensive inventory during slow seasons. Plan purchases around your sales patterns.

Buy inventory for peak seasons early enough to avoid shortages, but not so early that you tie up cash unnecessarily. Work backward from your busy periods to determine optimal ordering times.

Negotiate with suppliers for seasonal payment terms. Some vendors offer extended payment periods for orders placed during slow seasons, helping your cash flow.

Consider consignment arrangements for seasonal items. This shifts inventory risk to suppliers while still giving you products to sell.

Reduce regular inventory orders during slow periods. Use this time to sell through existing stock rather than accumulating more products.

Market differently by season

Adjust your marketing message and channels based on seasonal customer behavior. What motivates customers in December might not work in July.

During slow seasons, focus marketing on your most loyal customers. They’re more likely to buy when demand is generally low. Offer special deals or early access to new products.

Use slow periods to build relationships and brand awareness for the next busy season. This is often when marketing costs less because there’s less competition for advertising space.

Consider counter-seasonal marketing. Promote beach vacations during winter or warm clothing during summer clearance sales. You might find customers who plan ahead or live in different climates.

Use slow periods productively

Don’t just wait for busy season to return. Use quiet periods to improve your business.

This is the perfect time for employee training, system upgrades, equipment maintenance, and strategic planning. You have more time and attention to focus on improvements.

Develop new products or services during slow periods. Test them on a small scale so they’re ready for the next busy season.

Catch up on administrative tasks that get pushed aside during busy periods. Update your website, organize financial records, or research new suppliers.

Create seasonal promotions

Turn slow periods into opportunities with targeted promotions that give customers reasons to buy when they normally wouldn’t.

Offer off-season discounts to move inventory and generate cash flow. A lawn care service might offer discounted spring preparation services during winter months.

Bundle slow-moving products with popular items. This helps clear inventory while maintaining profit margins.

Create artificial urgency with limited-time offers. “Winter specials” or “summer clearance” events can motivate customers to buy during typically slow periods.

Monitor cash flow closely

Seasonal businesses need tighter cash flow management than businesses with steady sales patterns.

Create monthly cash flow projections that account for seasonal patterns. Update these regularly based on actual performance.

Arrange credit lines during good seasons when banks view your business more favorably. Having credit available during slow periods provides peace of mind and flexibility.

Negotiate payment terms with suppliers and vendors that match your seasonal patterns. Ask for extended payment periods during slow seasons.

Final thoughts

Seasonal fluctuations don’t have to threaten your business survival. With proper planning and smart strategies, you can turn seasonal patterns into competitive advantages.

The key is accepting that seasonality is part of your business model rather than fighting against it. Plan for the cycles, save during good times, and use slow periods productively.

Start implementing these strategies gradually. Pick one or two approaches that fit your business best and build from there. Over time, you’ll develop a systematic approach to managing seasonal swings that keeps your business stable and profitable year-round.